Stock Market Technical Analysis In Tamil Pdfl _BEST_

Stock Market Technical Analysis In Tamil Pdfl

Get files from these links:

Here is a possible title and article with html formatting for the keyword "Stock Market Technical Analysis In Tamil Pdf":

Stock Market Technical Analysis In Tamil Pdf: A Guide for Beginners

Stock market technical analysis is the study of price movements and patterns in the stock market using charts and indicators. Technical analysis can help traders and investors to identify trends, support and resistance levels, entry and exit points, and trading opportunities. Technical analysis can also help to measure the strength and weakness of the market sentiment and the psychology of the participants.

In this article, we will introduce some of the basic concepts and tools of stock market technical analysis in Tamil. We will also provide some sources where you can download or read more about stock market technical analysis in Tamil pdf.

What is a Chart?

A chart is a graphical representation of the price history of a stock or an index over a period of time. Charts can be displayed in different formats, such as line charts, bar charts, candlestick charts, etc. Each format has its own advantages and disadvantages, depending on the type of information and analysis you want to perform.

A line chart is the simplest form of a chart, which connects the closing prices of each trading session with a line. A line chart can show the general direction and trend of the price movement, but it does not show the details of the opening, high, low, and closing prices of each session.

A bar chart is a more detailed form of a chart, which shows the opening, high, low, and closing prices of each trading session with a vertical bar. The top of the bar represents the high price, the bottom of the bar represents the low price, and the horizontal lines on the left and right sides of the bar represent the opening and closing prices respectively. A bar chart can show the range and volatility of the price movement, as well as the direction and trend.

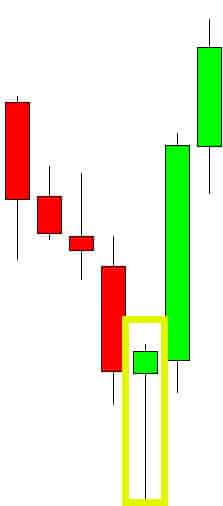

A candlestick chart is a variation of a bar chart, which uses different colors and shapes to represent the opening, high, low, and closing prices of each trading session. A candlestick consists of a body and a shadow. The body represents the difference between the opening and closing prices, while the shadow represents the difference between the high and low prices. The body can be either filled or hollow, depending on whether the closing price is higher or lower than the opening price. The color of the body can be either green or red, depending on whether the price has risen or fallen during the session. A candlestick chart can show more information about the price action and sentiment than a bar chart.

What are Trends?

A trend is the general direction and tendency of the price movement over a period of time. Trends can be classified into three types: uptrend, downtrend, and sideways trend.

An uptrend is a series of higher highs and higher lows in the price movement, indicating that the buyers are in control and that the demand is greater than the supply. An uptrend can be drawn by connecting at least two consecutive higher lows with a rising trend line.

A downtrend is a series of lower highs and lower lows in the price movement, indicating that the sellers are in control and that the supply is greater than the demand. A downtrend can be drawn by connecting at least two consecutive lower highs with a falling trend line.

A sideways trend is a series of horizontal highs and lows in the price movement, indicating that neither buyers nor sellers have a clear advantage and that the demand and supply are balanced. A sideways trend can be drawn by connecting at least two consecutive highs with a horizontal resistance line and at least two consecutive lows with a horizontal support line.

What are Support and Resistance?

Support and resistance are two important concepts in technical analysis that indicate the levels where buyers or sellers are likely to enter or exit the market. Support and resistance can act as barriers for price movements and influence future price directions.

Support is a level where buyers are expected to enter or increase their buying activity, preventing further price decline. Support can be identified by looking at previous lows or areas where buying pressure was strong. When price reaches support, it may bounce back up or consolidate before resuming its downward movement. If support is broken, it may indicate that sellers have gained more strength or that buyers have lost interest. In this case, support may become resistance for future price movements.

12c6fc517c